Mumbai: Aurobindo Pharma's promoter group has raised around ₹2,000 crore through a two-tranche promoter financing structure to fund platform acquisitions, including the Taj Banjara asset in Hyderabad. The borrowing is being routed through the promoters' real estate arm, Auro Realty.

The transaction is split into two parts. The ₹650 crore Series 1 comes with a 24-month tenor and a two-year put and call option, and ₹1,450 crore, which will be Series 2 with a four-year tenor.

Series 1 will carry a coupon of 11.75%, while Series 2 is likely to be priced at 15.5%.

The debt is backed by a pledge of promoter special purpose vehicles- Raidurgam Developers and Auro Realty - along with other hard collateral. These assets are together valued at more than ₹2,500 crore, supported by personal and corporate guarantees.

Raidurgam Developers (RDL) is the entity managing the Galaxy Tower project in Raidurgam, a Hyderabad suburb that is home to several high-tech companies. The collateral cover stands at nearly 2.5x, rising to around 4x with the other guarantees.

Exit visibility for lenders is expected from refinancing, project cash flows, and monetisation of assets, including the upcoming LRD project.

A spokesperson of Aurobindo Pharma did not respond to requests for comment.

Aurobindo Pharma reported revenues of around ₹31,000 crore and remains net cash positive.

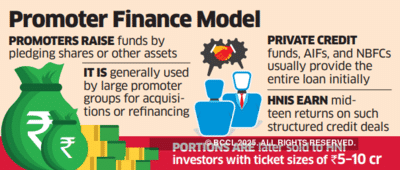

Promoters have been raising funds from alternate credit funds and private credit funds in high-yield money for various purposes. Last year, Kalyan Jewellers India's promoter, TS Kalyanarama, and promoter group had raised funds from funds including Motilal Oswal, 360 One in high-yield debt to increase their stake by acquiring a 2.36% from Warburg Pincus. The promoters have also pledged additional shares to secure loans from various financial institutions.

The transaction is split into two parts. The ₹650 crore Series 1 comes with a 24-month tenor and a two-year put and call option, and ₹1,450 crore, which will be Series 2 with a four-year tenor.

Series 1 will carry a coupon of 11.75%, while Series 2 is likely to be priced at 15.5%.

The debt is backed by a pledge of promoter special purpose vehicles- Raidurgam Developers and Auro Realty - along with other hard collateral. These assets are together valued at more than ₹2,500 crore, supported by personal and corporate guarantees.

Raidurgam Developers (RDL) is the entity managing the Galaxy Tower project in Raidurgam, a Hyderabad suburb that is home to several high-tech companies. The collateral cover stands at nearly 2.5x, rising to around 4x with the other guarantees.

Exit visibility for lenders is expected from refinancing, project cash flows, and monetisation of assets, including the upcoming LRD project.

A spokesperson of Aurobindo Pharma did not respond to requests for comment.

Aurobindo Pharma reported revenues of around ₹31,000 crore and remains net cash positive.

Promoters have been raising funds from alternate credit funds and private credit funds in high-yield money for various purposes. Last year, Kalyan Jewellers India's promoter, TS Kalyanarama, and promoter group had raised funds from funds including Motilal Oswal, 360 One in high-yield debt to increase their stake by acquiring a 2.36% from Warburg Pincus. The promoters have also pledged additional shares to secure loans from various financial institutions.

You may also like

Trigger Point season 3 release date confirmed with intense teaser

'We love Viktor': Trump calls himself 'the only one that matters' while praising Hungarian PM Orban at Gaza summit

Channel 5 viewers issue complaint minutes into Prince Andrew documentary: 'What a waste'

'Love was never about...': Amid Trudeau-Katy Perry dating rumours, ex-wife Sophie Grégoire shares 'letting go' Instagram post

The Boys star speaks out as Prime Video faces backlash for axing show